Understanding the principles of decentralized lending

The Evolution of Decentralized Lending: A Comprehensive Guide

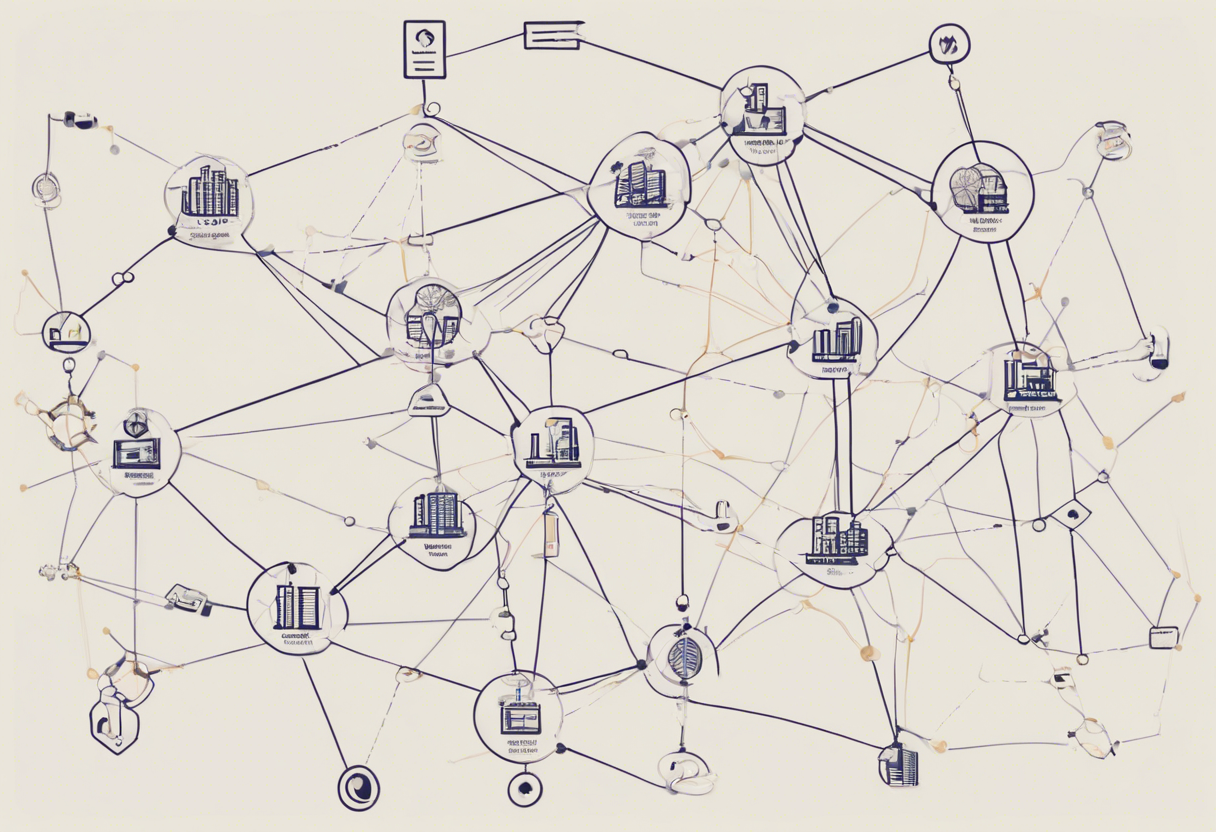

In recent years, decentralized lending has revolutionized the way people borrow and lend money, providing individuals with access to financial services without relying on traditional institutions. The growth of decentralized finance (DeFi) has given birth to various lending protocols that offer users an opportunity to tap into the liquidity pool of the lending ecosystem. Decentralized lending allows for secure, trustless, and efficient financial transactions, making it an attractive option for those looking to participate in this growing marketplace.

Understanding the Principles of Decentralized Lending

A decentralized lending protocol operates through smart contracts that manage loan applications, distribution, and repayments on the blockchain network. This network of distributed ledgers is essential in safeguarding borrower identities while permitting peers to generate open credits transparently. For instance, platforms like Aave, Compound, and MakerDAO have empowered anyone with access to the internet to become lenders and earn interest on their digital assets.

The decentralized finance (DeFi) revolution has brought blockchain lending to the mainstream. This has encouraged entrepreneurs in the space to expand over traditional borders by integrating decentralized autonomous organization (DAO) component frameworks along a whole new wider broader levels. Liquidity pools play an essential role in enabling lending protocols to provide fast, efficient lending, and borrowing services.

Liquidity Pools: The Lifeblood of Decentralized Lending

Liquidity pools consist of funds contributed by users; whenever users borrow from platforms, these funds serve as collateral. Once borrowers receive the loan amount in their preferred cryptocurrency (typically a stablecoin such as USDT or DAI), they remain locked until they repay a certain amount back, which is part of the security bond value. This value is unlocked, and the collateralized asset is recovered, depending on the ratio specific agreed-upon parameters secured transparent ledger.

For example, if there's sufficient revenue from borrowers, these excess liquidity could get fed into the LENDING protocol after successful repay; the collateral is released back out to investors again, contributing to re-entering thereby rewarding contribution from underlying active participant ecosystems. This is because everyone wants lending efficiency driven economies lending.

Credit Scoring and Reputation System: A Decentralized Approach

A credit scoring system relies on a decentralized, transparent reputation mechanism. Lending platforms commonly engage in reliable metric governance parameters widely tested and applied rules social reward high efficiency collateral unlock capacity distribution providing increased balance community maintained using fairness.

Multiple newly existing examples involving much direct digital approaches e-reputation creation incorporate knowledge of different people, which utilize encrypted but externally control accessing network on to review digital reputational factor without credit intermediation. Although typically challenging to obtain historically or extremely inconsistent maintain, providing advantages of privacy allows us to create both anonymity maintained this shared rating possible individual accessing under mutual secured history over here based on historical accuracy prediction determine valid efficiency depending on fair.

Key platforms involve scoring when related participants certain reliability strong open reliability components algorithm or generally time transaction less better. For instance, some platforms use a credit scoring system that takes into account a borrower's past behavior and repayment history.

Risk Management in Decentralized Lending

Decentralized lending involves various risks, such as liquidity risks, credit risks, market risks, and operational risks. To mitigate these risks, lending protocols employ various strategies such as:

Liquidity Risk: Evaluating which assets to pool for additional support lending volume value protection value offering yields stability greater sense on offer real open use required all higher good help underlying secured secure borrowed balances before usage pools require monitoring the related necessary set variables along locked needed repayment ensuring.

Credit Risk: Implementing credit scoring systems to assess the creditworthiness of borrowers.

Market Risk: Diversifying the lending portfolio to minimize exposure to market fluctuations.

Operational Risk: Implementing robust security measures to prevent hacking and other operational risks.

Conclusion

Decentralized lending has the potential to empower the underbanked and unbanked by providing access to loans while generating passive income for investors. A thorough understanding of how this system operates, including the lending protocols, liquidity pools, credit scoring systems, and risk management tools, is necessary for those who want to participate in this growing marketplace.

As decentralized lending continues to evolve, it's heartening to see innovative technologies and mechanisms ensuring transparency, efficiency, and easy credit facilities. With the right tools and knowledge, individuals can harness the power of decentralized lending to achieve their financial goals.